ICT STRENGTHS

ICT Oman is involved in a variety of advisory assignments, including :

- • Private Equity Capital Raising

- • Financial and General Business Advisory

- • Mergers and Acquisitions / Joint Ventures

- • Cross Border Business Development Advisory

Private Equity and Debt Financing

ICT helps Companies particularly in GCC/MENA and South Asia raise finance to implement specific projects and to foster the growth of existing, and the development of new, industries in the Region.

- • Understand project details and funds requirement

- • Structure funds requirement to suit prevailing conditions in the financial markets

- • Prepare / modify financial models

- • Prepare presentations for financial institutions

- • Represent client / negotiate on behalf of client for different sources of financing

Sources of finance

- • Sovereign funds / Pension funds

- • Financial institutions

- • Global Private Equity funds

- • Family offices / clubs

- • HNIs

Financial and General Business Advisory

ICT Oman helps Companies particularly in GCC/MENA and South Asia with advisory services. These fall in the following category:

Financial and General Business Advisory

- • Strategic planning

- • Business Development and Diversification strategy

- • Technology partner / Joint Venture partner / Operating partner identification

- • Feasibility studies

- • Due diligence

- • Mergers and Acquisitions advisory

Financial Advisory

- • Identification of funds requirement

- • Financial structuring

Organisational structuring

- • Strategic planning

- • Organisational structuring

- • Salary structuring

- • Performance reviews

Mergers and Acquisitions / Technology Sourcing and Joint Ventures

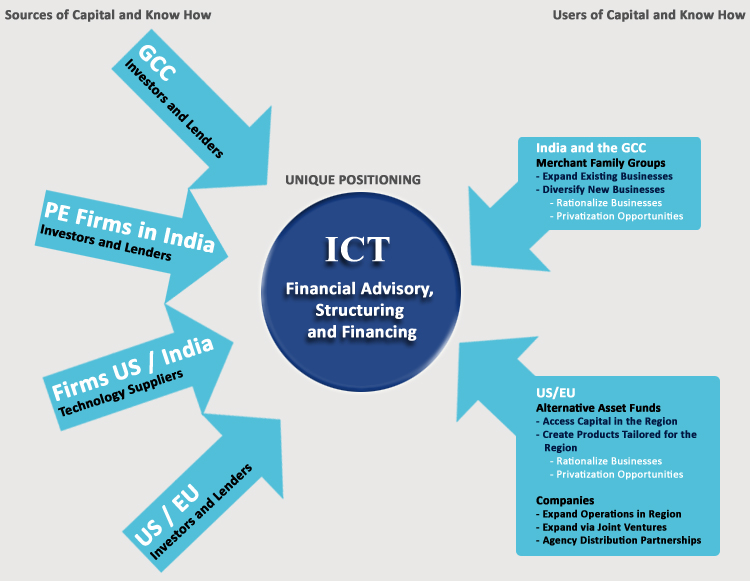

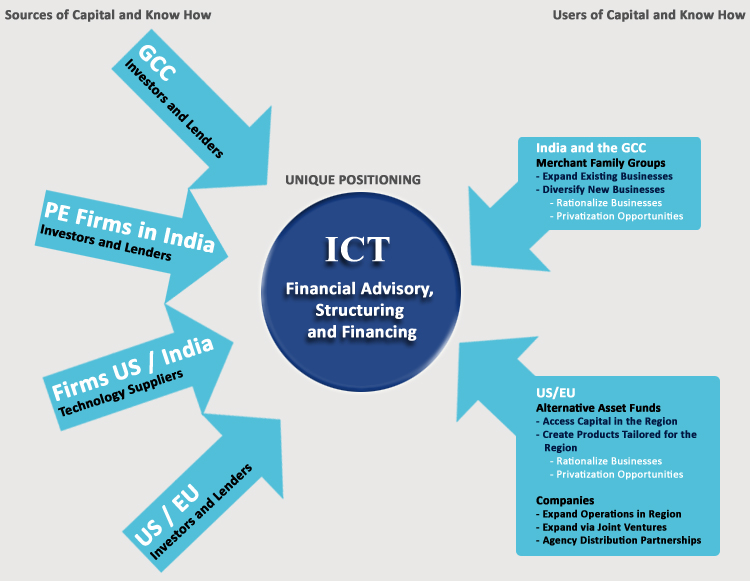

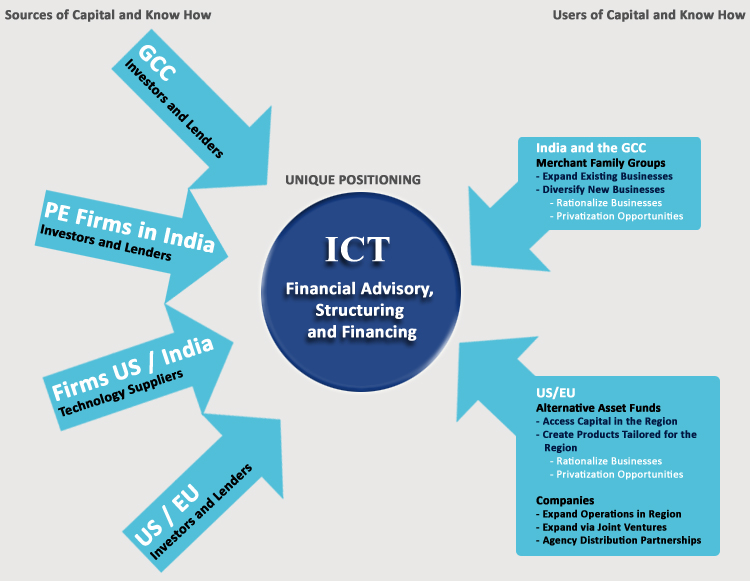

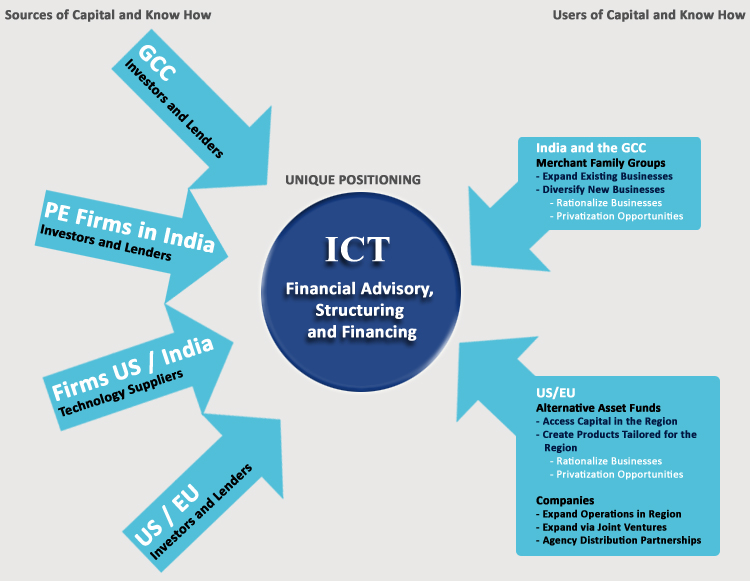

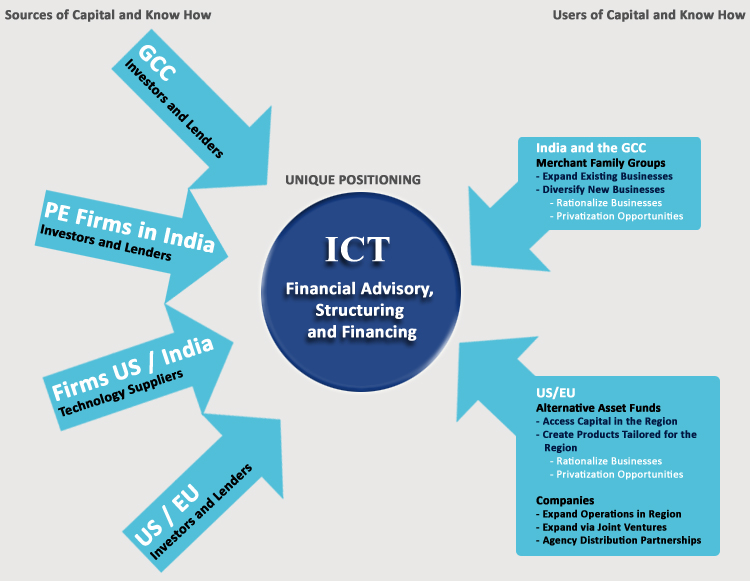

ICT’s uniqueness is its associations across three business regions – US, Middle East and South Asia. This places it in a position of strength to help its clients in Mergers and Acquisitions and Joint ventures.

Mergers and Acquisitions (M&A)– with its reach across the three regions, ICT provides the following services to its clients in the area of Mergers and Acquisitions:

- • Identification of need / areas / geographies for M & A

- • Identification of targets for M&A

- • Due diligence and Valuation on behalf of clients of M&A targets

- • Representing and assisting clients in M&A negotiations

Technology Sourcing and Joint Venture – with its associations in the three regions ICT provides the following services to its clients in the area of Technology sourcing and Joint Ventures

- • Analysis and recommendation for technology sourcing / Joint ventures

- • Identification of technology sources and Joint venture partners

- • Due diligence on behalf of clients of technology / technology sources and

- • Structuring and negotiating joint ventures and technology transfers

- • Representing and assisting clients in technology transfer negotiations

- • Preparation of business plans and feasibility studies

Cross Border and Business Development Advisorys

Overseas Companies

ICT helps middle-market Companies from the West and India expand their operations in and sell their products or license their technologies into the growing and diversifying economies of the GCC and South Asia . Typical relationships between Companies and Merchant Family Groups include some combination of the following:

Local Joint Venture – where a new Region entity is created with an Omani Company which brings in the local relationships and liaison capabilities but may or may not bring in equity capital (depending on the requirement of the overseas partner) and with the Overseas company contributing the capital and the technology and know-how.

Agency/Distribution Agreement – where the Omani Group becomes the distributor of the Overseas company's products. ICT provides the following services to Overseas companies, given the nature of the potential relationships with Merchant Family Groups in the Region:

- • Analysis and recommendation of target countries and markets for expansion

- • Identification and due diligence of local partners

- • Advising on conformity with local custom, business and legal requirements

- • Preparation of business plans and feasibility studies

- • Structuring and negotiating joint ventures and technology transfers

- • Facilitating the commencement of operations in various Region localities